Australian Government Bonds - Bond Adviser

4.8 (771) · $ 27.00 · In stock

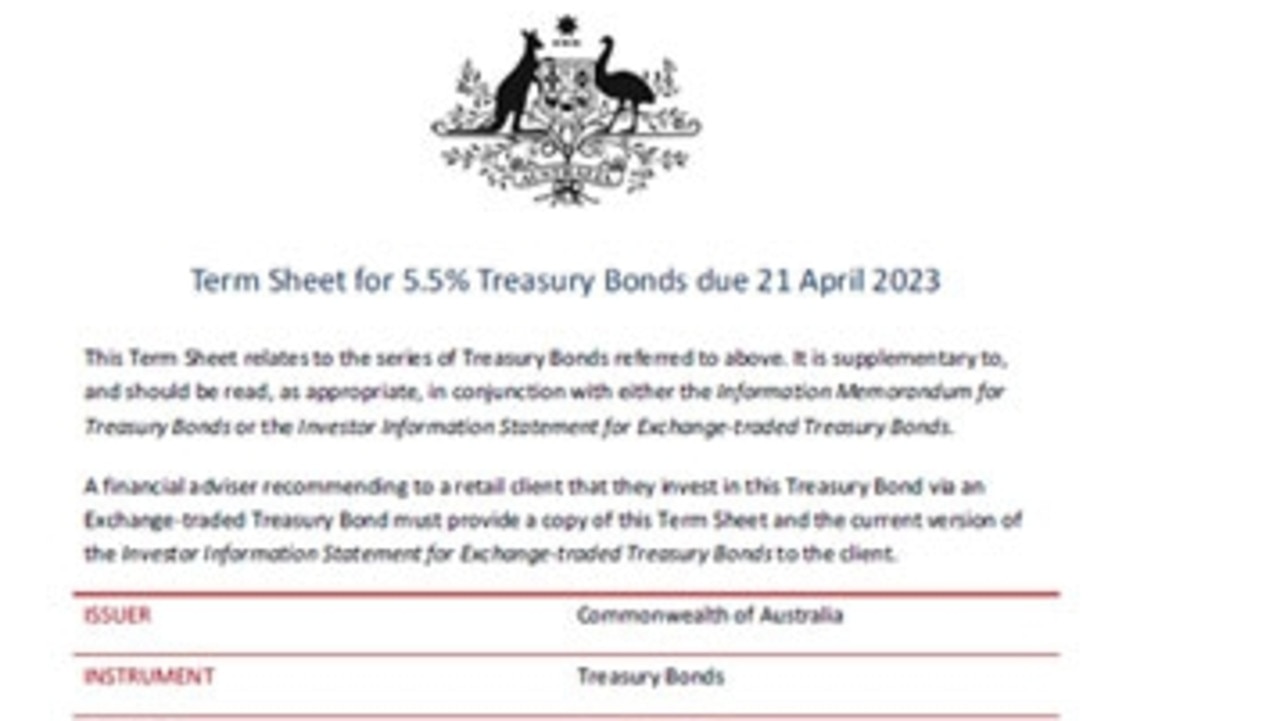

Commonwealth Government Bonds (CGS) are medium to long term debt issued by the Treasury through the Australian Office of Financial Management (AOFM). These securities pay a fixed coupon semi-annual in arrears, which are redeemable at face value on the specified maturity date and are the most liquid fixed income security in the Australian. Bonds issued

Guide to Buying Bonds in Australia – Forbes Advisor Australia

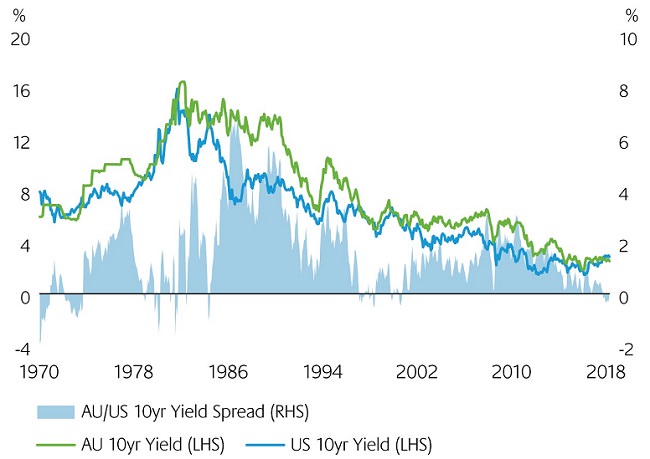

The impact of negative Australian versus US rate spreads

Why are Bond Yields High for Aussies? – Forbes Advisor Australia

Managed Portfolios

Understanding How Foreign Bonds Work - SmartAsset

Solved] The links in the question are as follow

How to Invest in Treasury Bonds

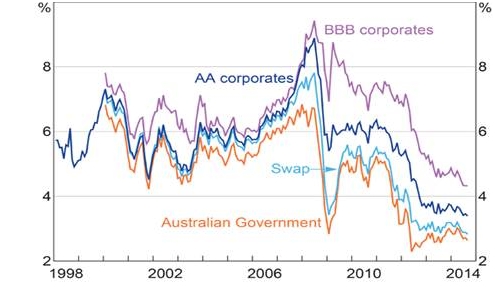

Record low yields on Australian corporate bonds – but what about credit spread levels?

Australian Treasury bond scam with realistic rates of return is the new fraud threat

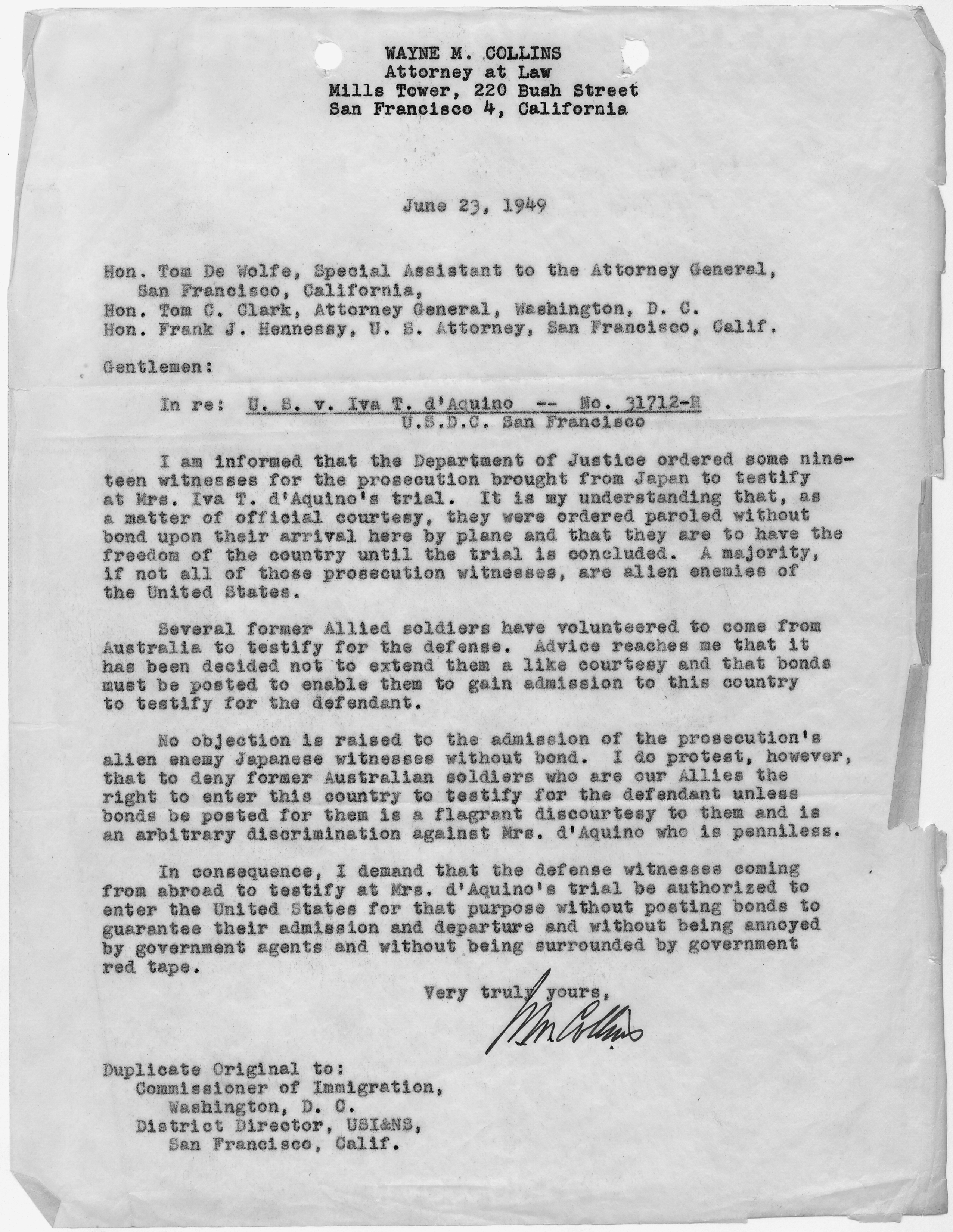

File:Letter from Wayne Collins, attorney for the defense, to Tom DeWolfe, Special Assistant to the Attorney General, et al. - NARA - 296670.jpg - Wikipedia