Should We Eliminate the Social Security Tax Cap? Here Are the Pros

4.9 (556) · $ 27.50 · In stock

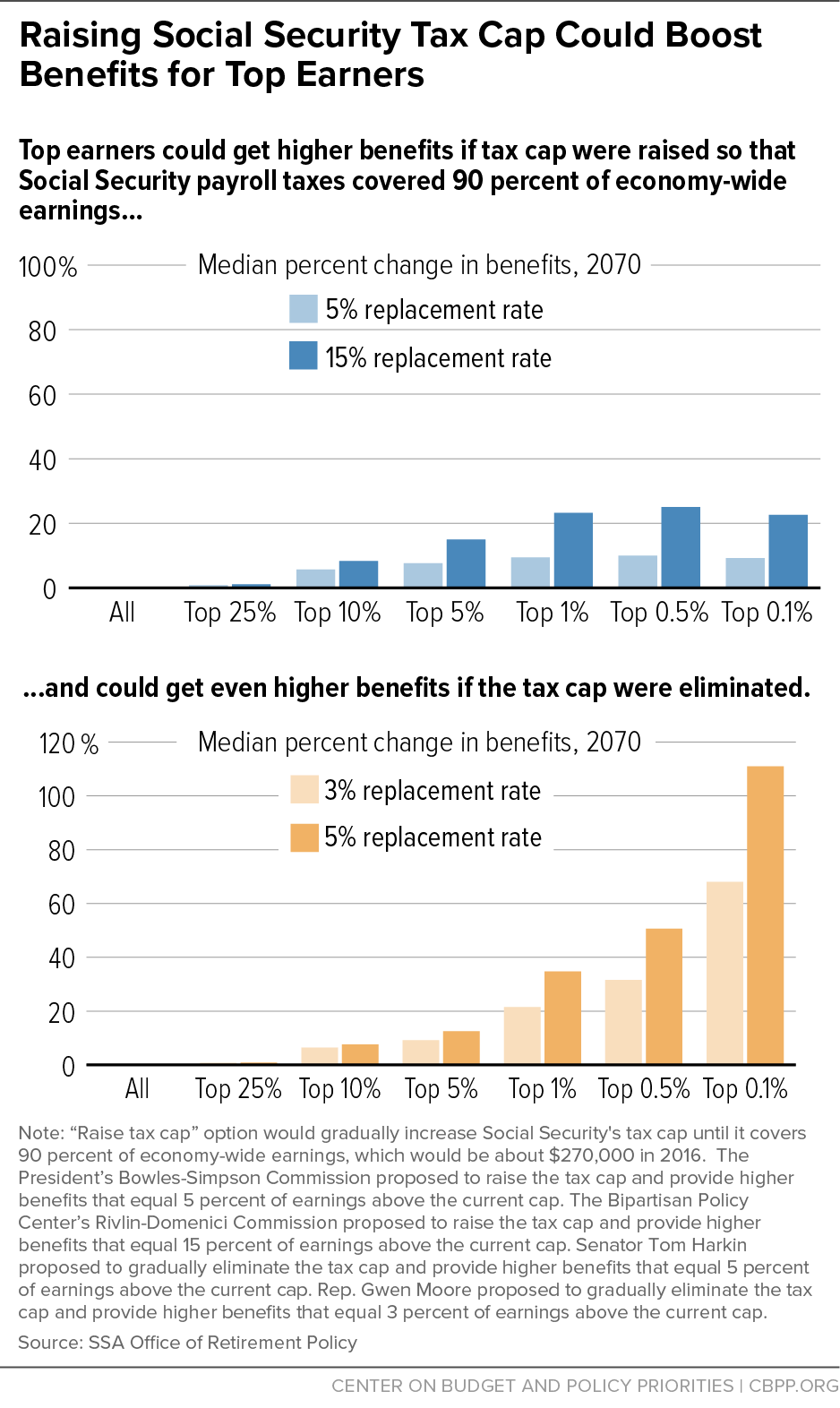

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

Social Security COLA 2024 may impact your taxes in a big way

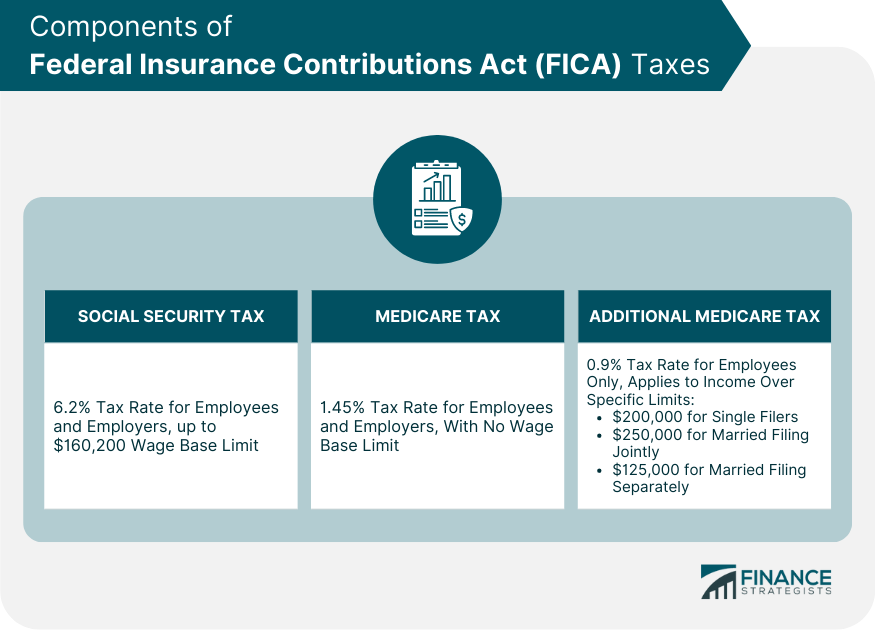

FICA Tax: What It is and How to Calculate It, fica tax

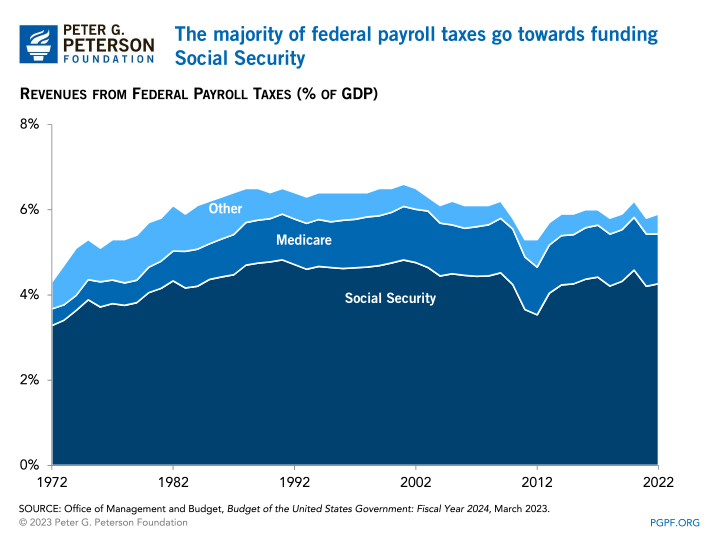

Payroll Taxes: What Are They and What Do They Fund?

What is the FICA Tax Refund? - Boundless, fica tax

Payroll Taxes: What Are They and What Do They Fund?

Understanding FICA Taxes and Wage Base Limit, fica tax

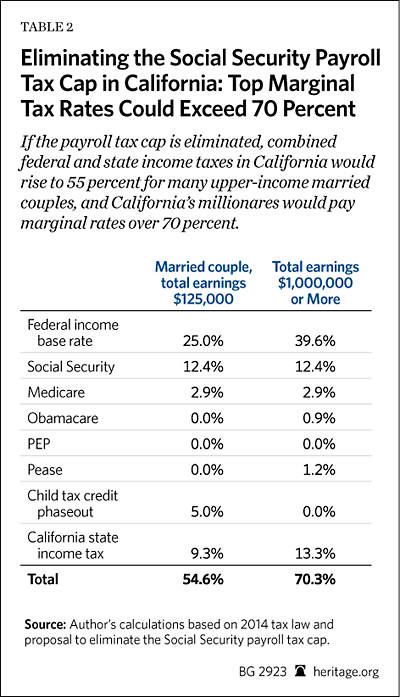

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much

Increasing Payroll Taxes Would Strengthen Social Security

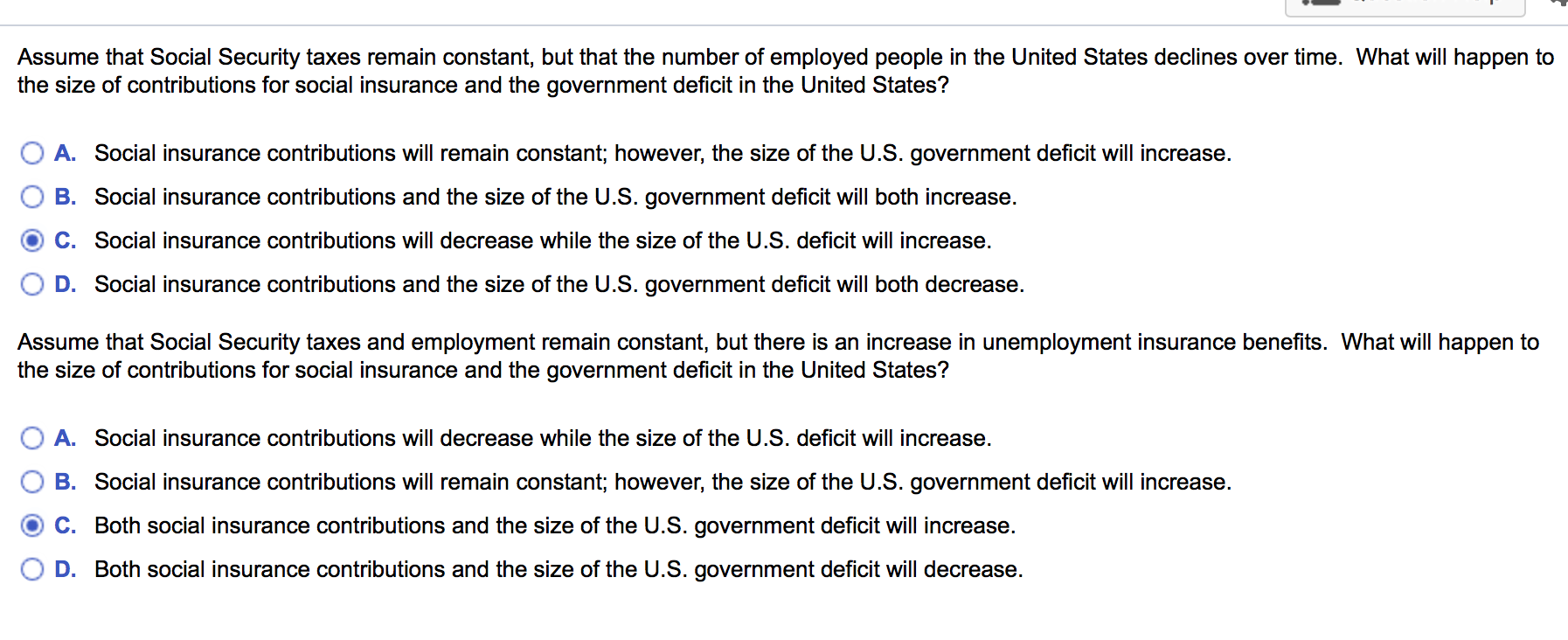

Solved Assume that Social Security taxes remain constant

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

FICA Tax: What It is and How to Calculate It, fica tax

The Peter G. Peterson Foundation on LinkedIn: Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

Research: Income Taxes on Social Security Benefits

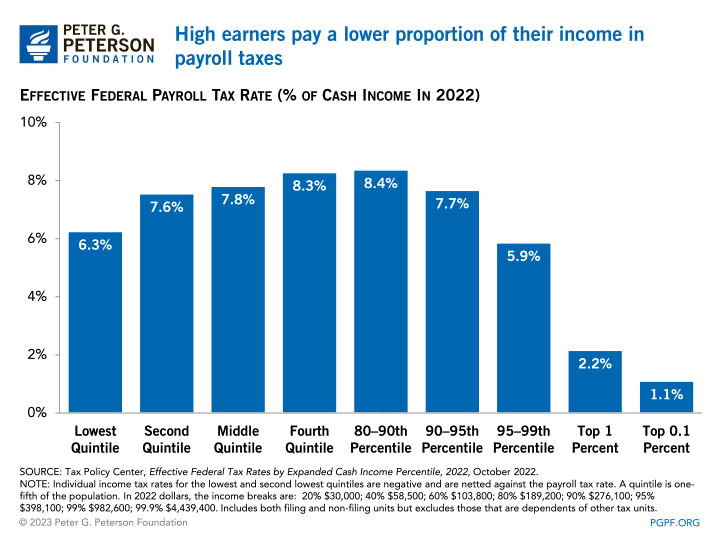

What are the major federal payroll taxes, and how much money do they raise?