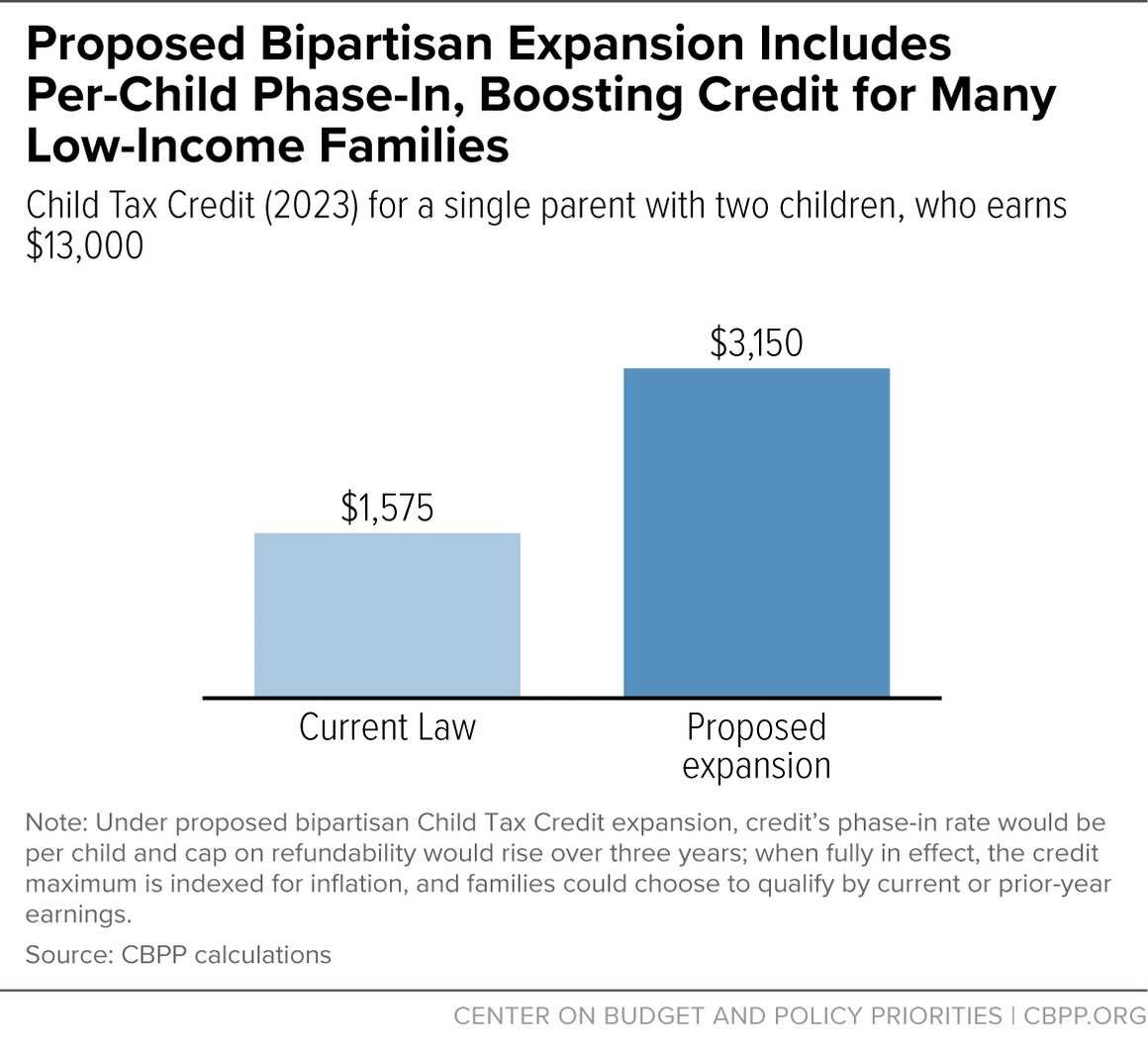

About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

4.7 (420) · $ 14.50 · In stock

Half a million or more children would be lifted above the poverty line when the proposal is fully in effect in 2025.

Lisa Jansen Thompson posted on LinkedIn

Finally, a Bipartisan Bill That Would Help All Families

Center for Law and Social Policy

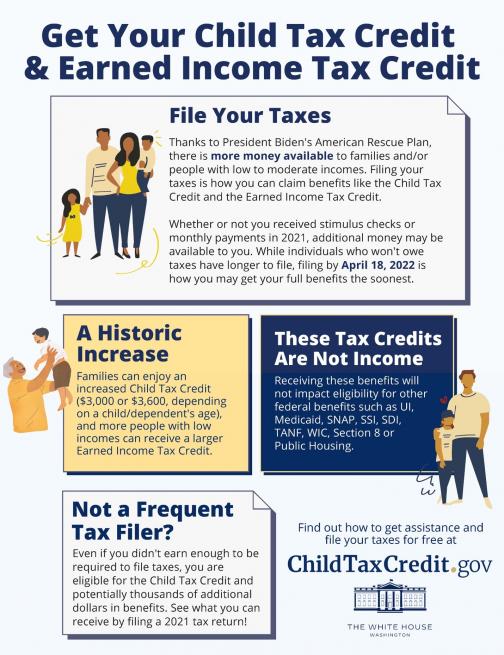

It's Not Too Late To Claim The 2021 Child Tax Credit, 46% OFF

Center on Budget and Policy Priorities report highlights benefits of proposed child tax credit expansion

House passes bill that could give families a nearly $700 tax break

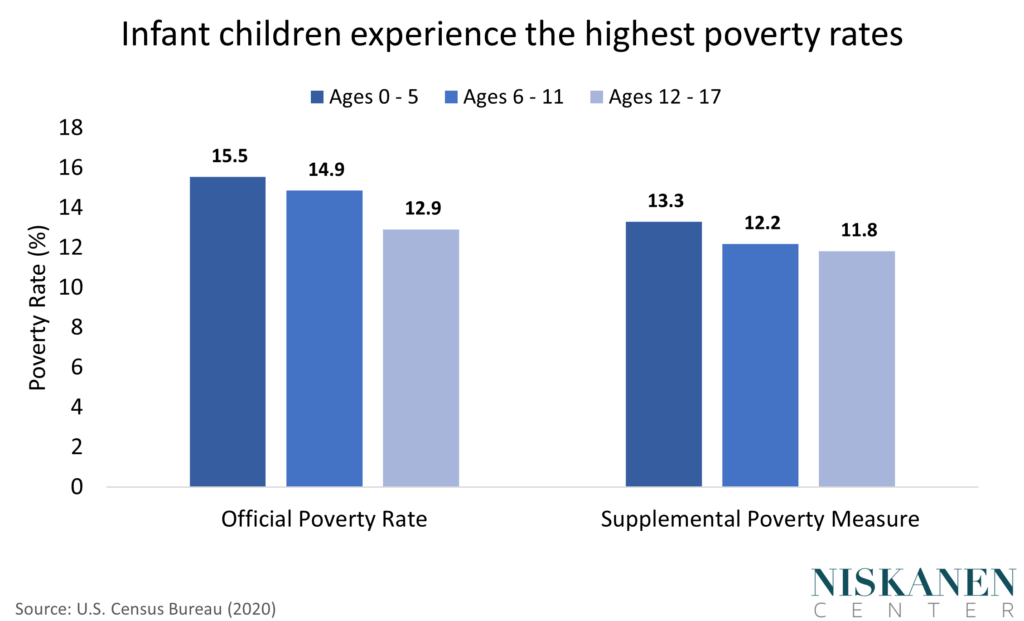

The Child Tax Credit and Its Potential Impact on the Lives of Children and Future of the Nation

About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

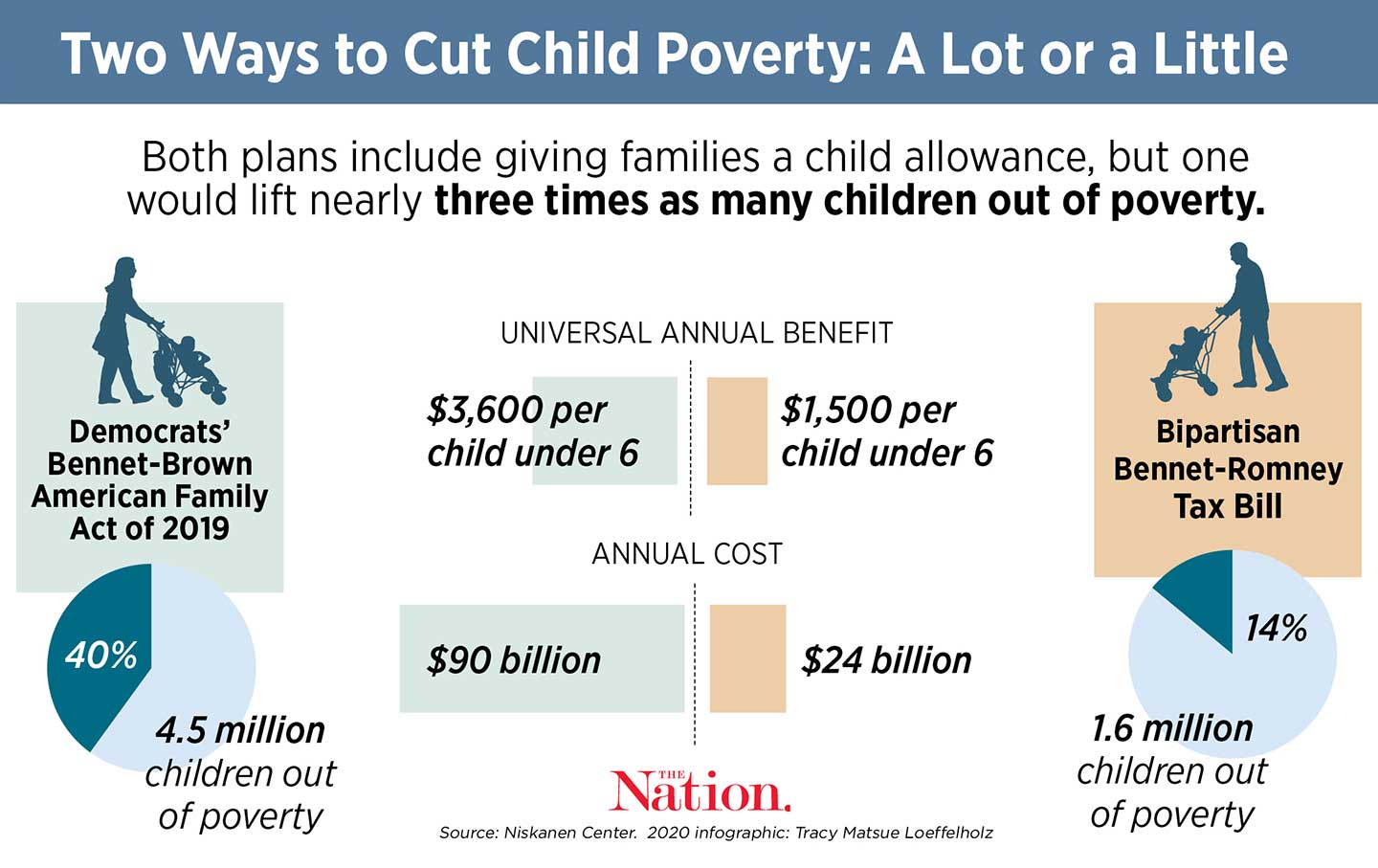

Bipartisan reform options for the Child Tax Credit - Niskanen Center