In-Kind Donations Accounting and Reporting for Nonprofits

4.7 (660) · $ 24.50 · In stock

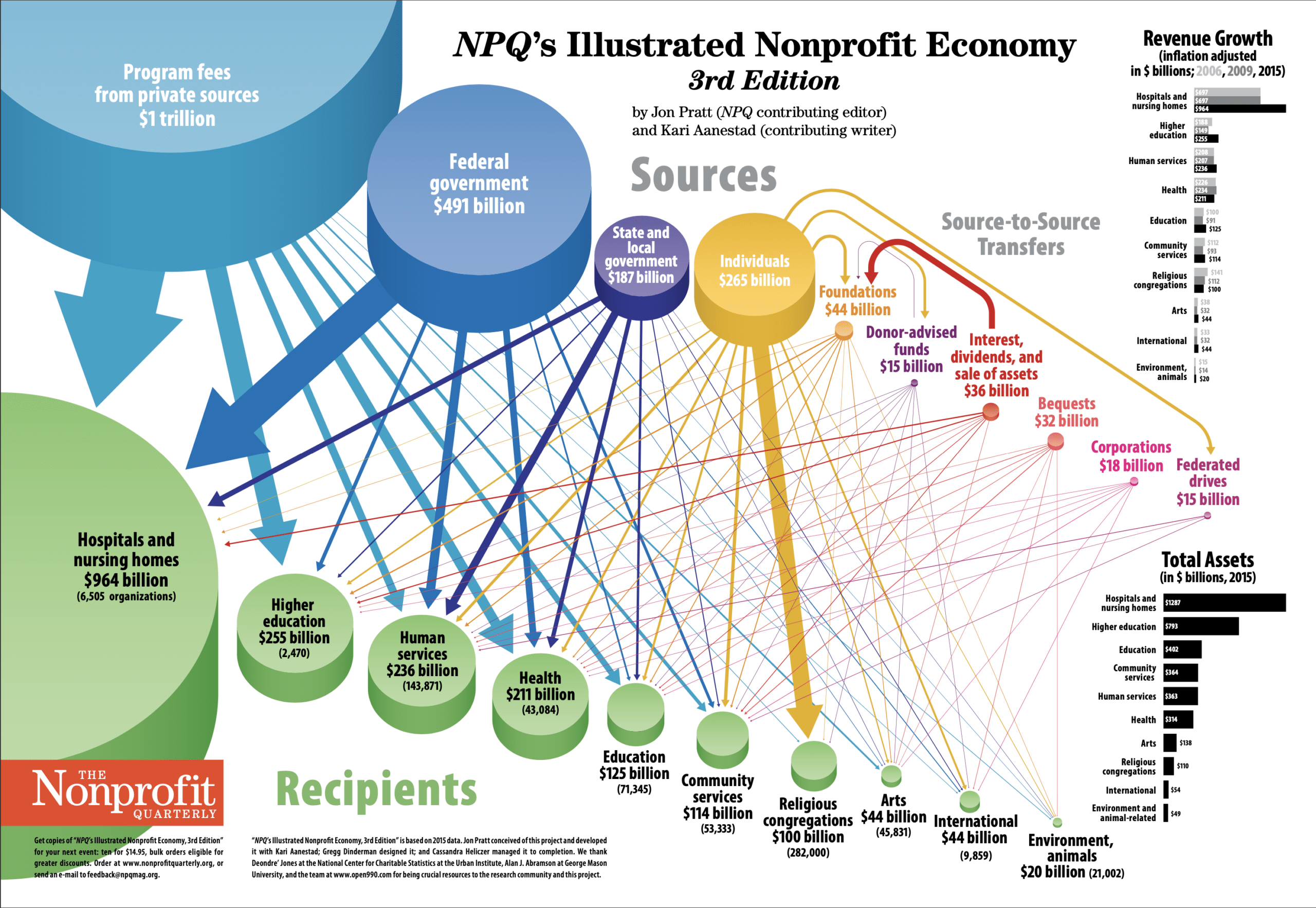

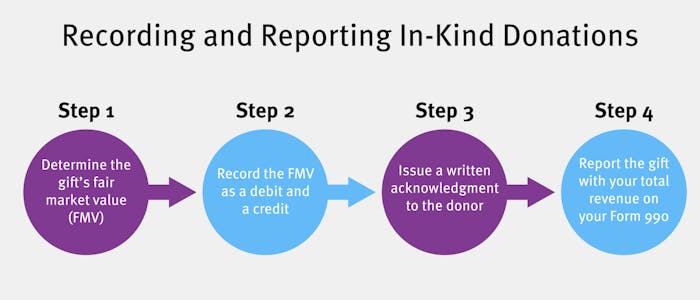

Even though in-kind gifts are a major source of support for many nonprofits, recording and reporting them properly can present some unique challenges.

How to Accept and Record In-Kind Gifts - Hawkins Ash CPAs

CFO Selections

Your Complete Guide to In-Kind Donations

Cash & In-Kind Contributions

Best Practices in Nonprofit Cost Allocation Methodologies

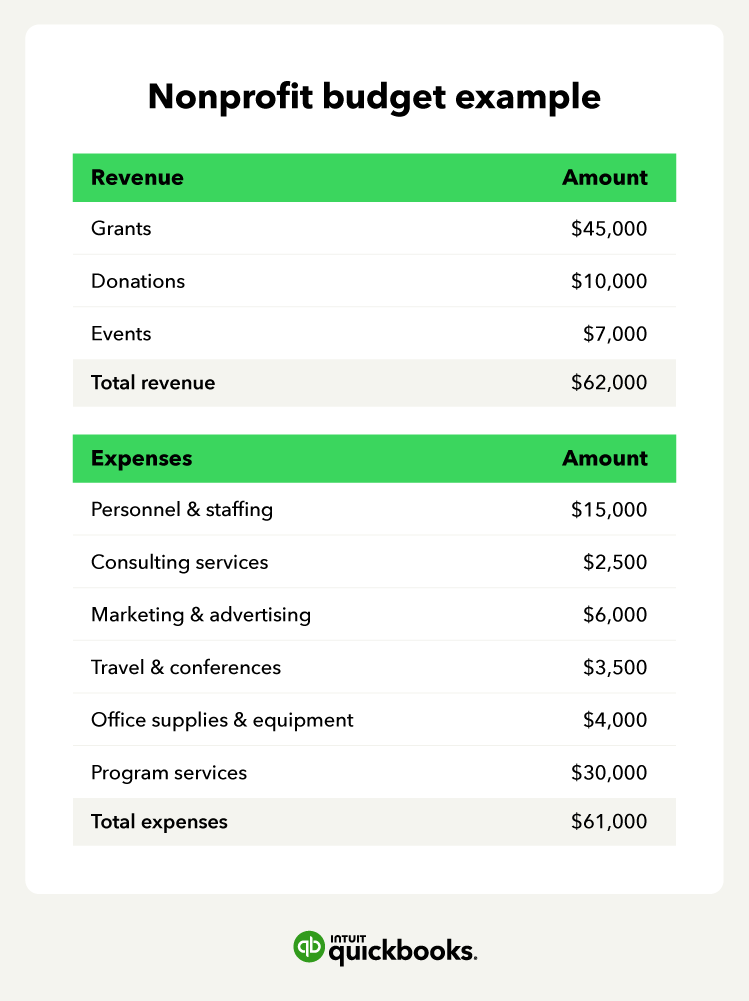

Nonprofit accounting: A beginner's guide

Tracking In-Kind Donations for Businesses & Nonprofits — DonationMatch

Accounting and Reporting for Stock Gift Donations to Nonprofits

In-Kind Donation: Your Guide to Raising Money without Raising

![Free Printable Nonprofit Financial Statement Templates [Excel]](https://www.typecalendar.com/wp-content/uploads/2023/08/Nonprofit-Financial-Statement.jpg)

Free Printable Nonprofit Financial Statement Templates [Excel]

Non Business Entity Strategic Planning Models Sources Of, 59% OFF

In Kind Contributions Reporting, Tangible Goods

In-Kind Donations: The Ultimate Guide + How to Get Started

(mh=uCidFrlNu5H7mmeG)0.jpg)