Section 44B: Income From Shipping Business For Non-Residents

4.9 (672) · $ 12.00 · In stock

Section 44B lays down rules for non-residents in shipping. Here’s all you need to know about presumptive income, tax rate and calculation.

Know About Section 44B of Income Tax Act, 1961

Sales taxes in the United States - Wikipedia

Flag of convenience - Wikipedia

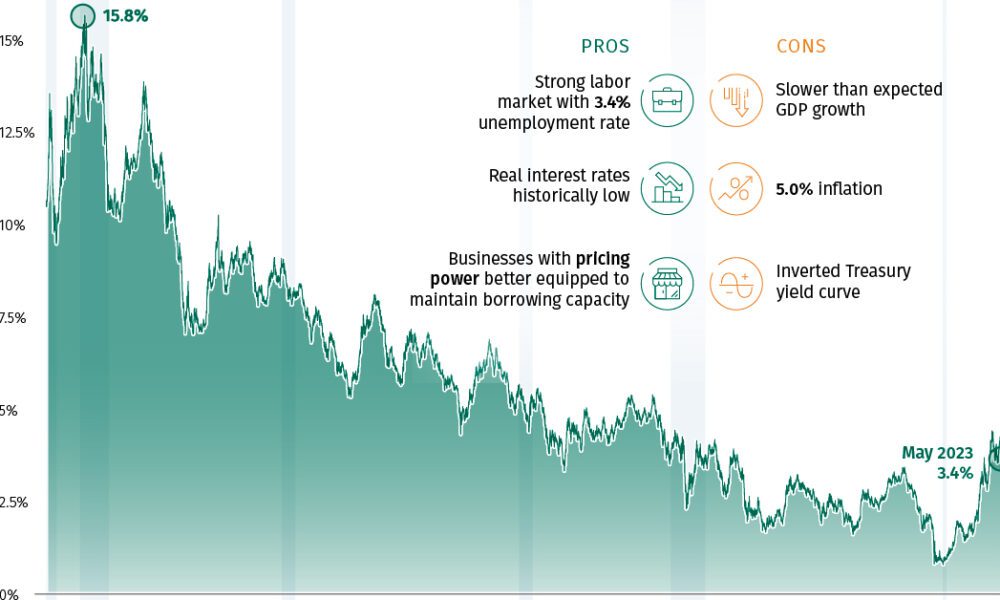

Visualizing 40 Years of U.S. Interest Rates

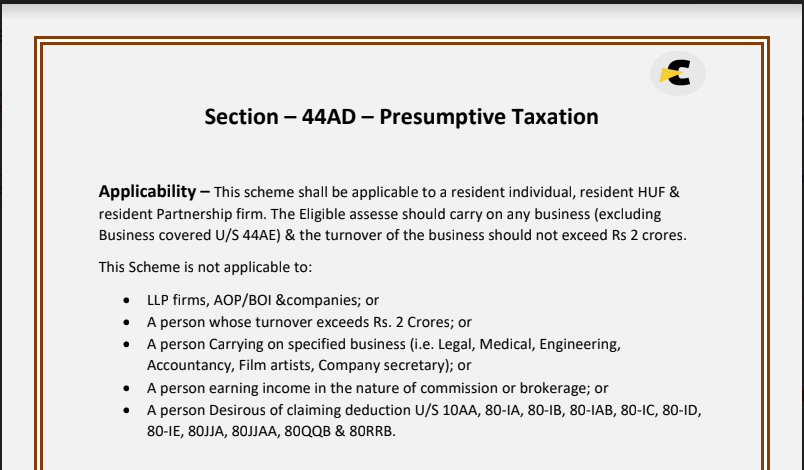

Presumptive taxation

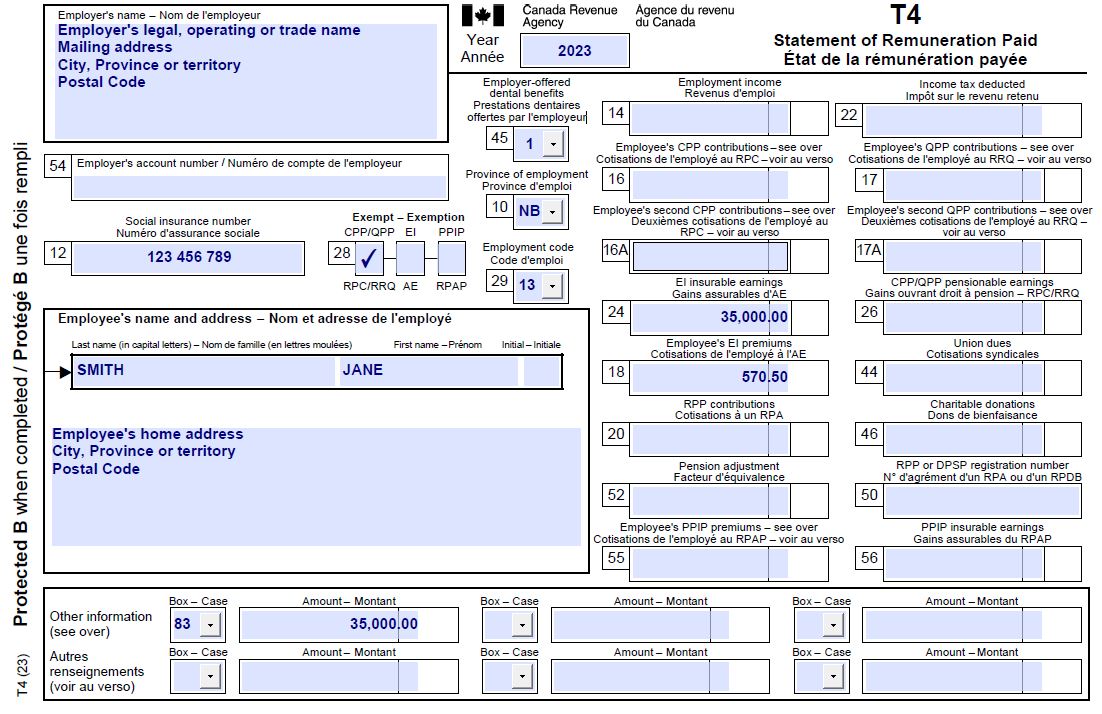

T4 slip – Employers

The truth about working on a cruise ship – DW – 01/25/2023

![International Taxation: Taxation of Non-resident's Shipping Business [Section 44B and 172 of IT Act]](https://i.ytimg.com/vi/5w6Nb-oF_vo/sddefault.jpg)

International Taxation: Taxation of Non-resident's Shipping Business [Section 44B and 172 of IT Act]

Tax presentation business income

Section 44AD – Presumptive Taxation for small businesses

You may also like