Small Business - Automobile Taxable Benefits

4.7 (373) · $ 32.00 · In stock

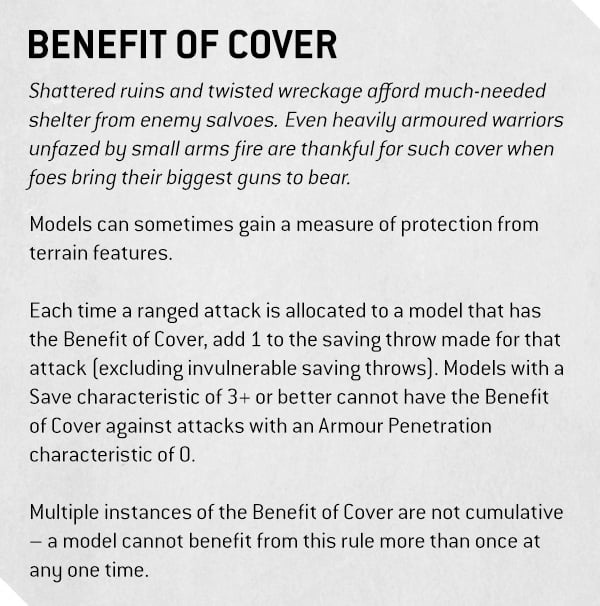

Automobile Taxable Benefits - Operating Cost Benefit, Reduction if Business Use 50% +

Jeff D'Ambrosio Tax Benefits

Towbin Dodge - A BusinessLink Dealer in Las Vegas, NV

How Small Business Owners Can Combine Section 179 and Cost Segregation to Reduce Tax Liabilities and

Small Business Tax Benefits on Deducting Vehicle Costs

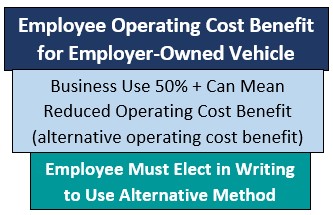

The Tax, Legal, and Business Implications of Providing a Company Vehicle, Vehicle Allowance, or Mileage Reimbursement - Journal of Urgent Care Medicine

What You Need to Know for the 2024 Tax Season - The New York Times

2024 Everything You Need To Know About Car Allowances

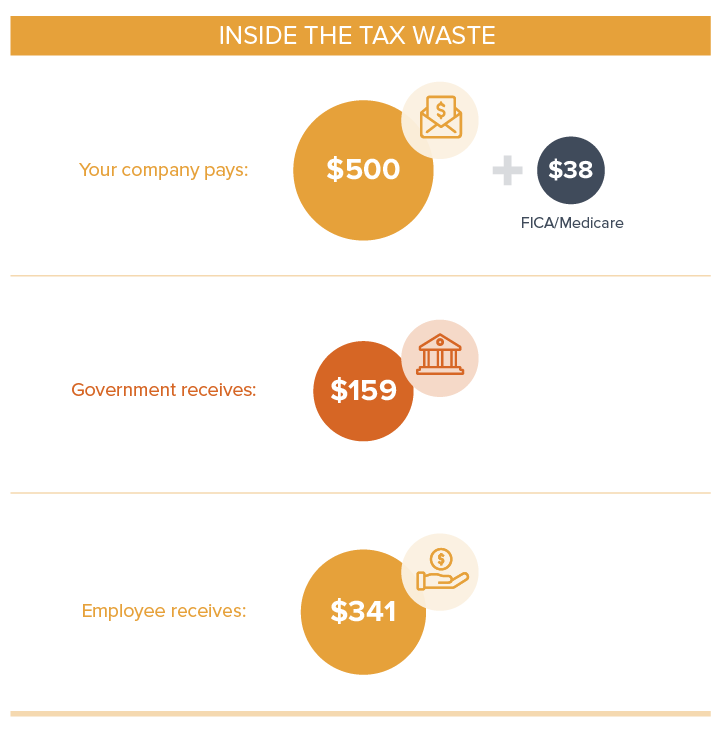

Tax Deduction on Chevy Commercial Vehicles - Seacoast Chevrolet

Tax Benefits on Ram Inventory Tutton Chrysler Dodge Jeep RAM of Jasper

23 tax breaks for small businesses in 2024

Section 179 Deduction List for Vehicles

Section 179 Tax Benefit

:max_bytes(150000):strip_icc()/6-ways-to-write-off-your-car-expenses.aspx-Final-97003f07090546d99b4e2cf41c552cbd.jpg)

6 Ways to Write Off Your Car Expenses

17 Big Tax Deductions (Write Offs) for Businesses

Tax Deductions and Write-Offs for Sole Proprietors