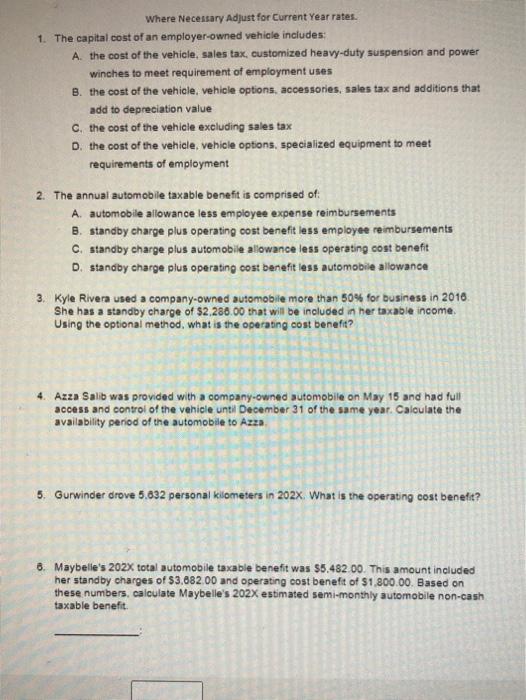

Small Business - Automobile Taxable Benefits - Operating Cost Benefit

4.6 (178) · $ 6.50 · In stock

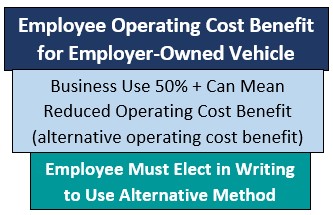

Automobile Taxable Benefits - Operating Cost Benefit, Reduction if Business Use 50% +

:max_bytes(150000):strip_icc()/totalcostofownership.asp-final-c09b08a2bcfd495aa00e4dc73cae5871.png)

Total Cost of Ownership: How It's Calculated With Example

Small Business - Automobile Taxable Benefits - Automobile Sales People

What are the Taxable Benefits for Non-Cash Operating Costs?

Business Expense Categories Cheat Sheet: Top 35 Tax-Deductible Categories

Company Vehicle: Leasing or Buying a Car Under a Corporation

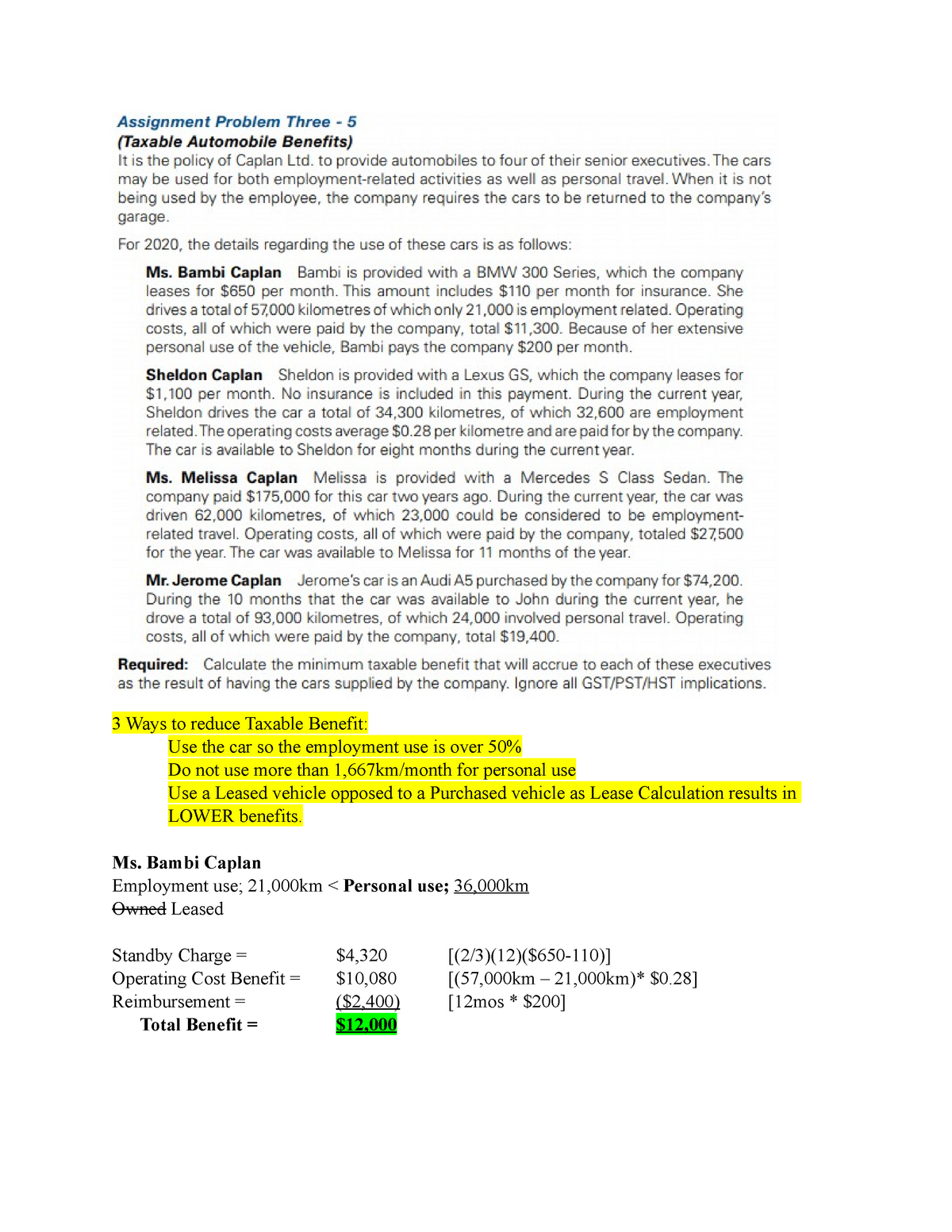

Taxation 1: Homework 3 - AP 3-5, 9, 11 - 3 Ways to reduce Taxable Benefit: Use the car so the - Studocu

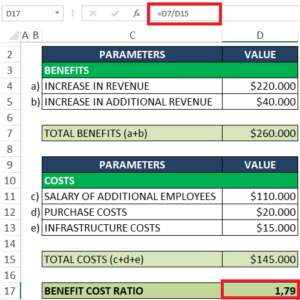

Cost Benefit Analysis Example and Steps (CBA Example) - projectcubicle

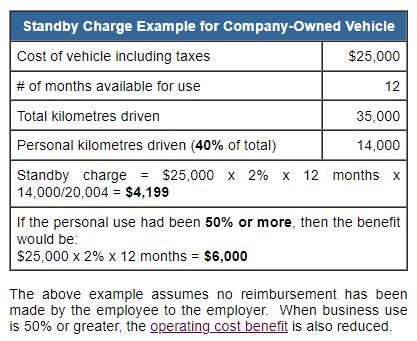

Small Business - Automobile Taxable Benefits - Standby Charge

Taxable Benefits In Canada: What You Should Know As An Employer

.svg)

Is The Personal Use Of Company Cars a Tax Benefit in Canada?

Step-By-Step: How To Claim Motor Vehicle Expenses From The CRA

Solved Where Necessary Adjust for Current Year rates. 1. The

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg)

Section 179: Definition, How It Works, and Example