What Type of Life Insurance Is Right for You?

4.6 (367) · $ 21.50 · In stock

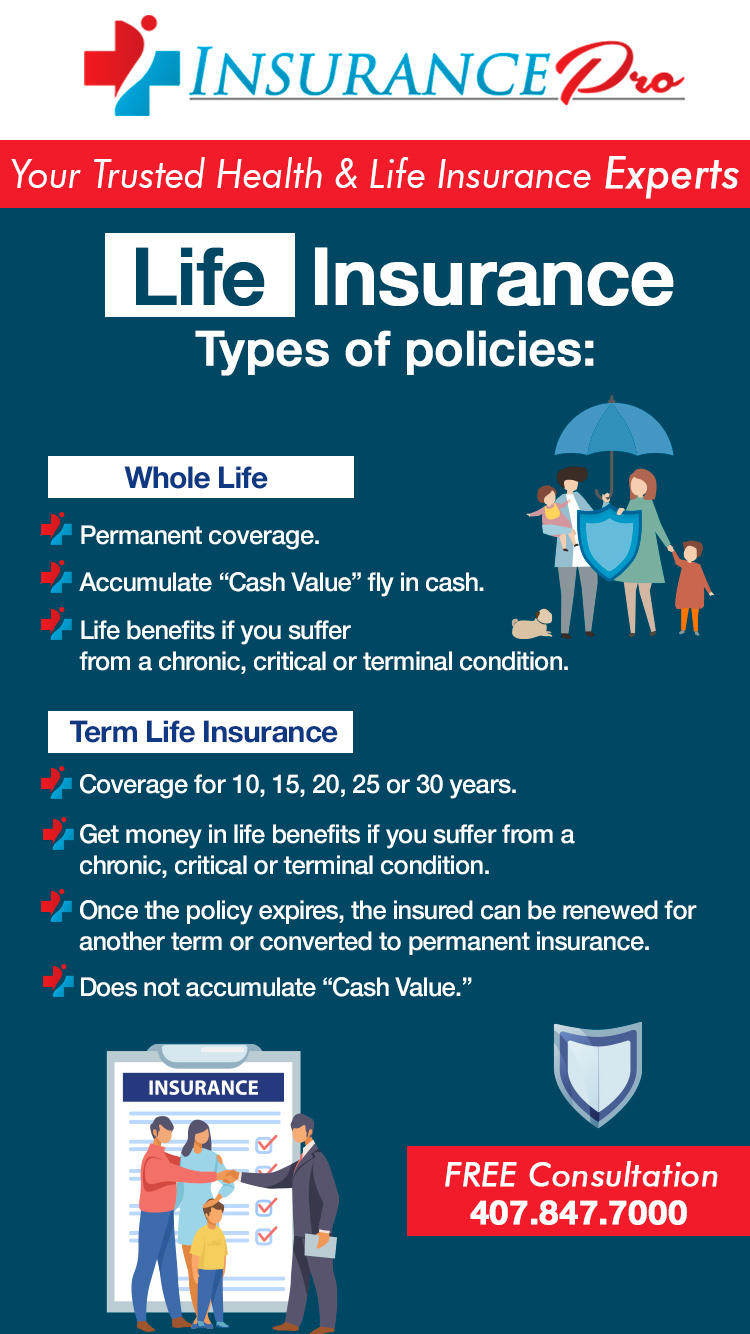

All life insurance policies have one thing in common – they’re designed to pay money to “named beneficiaries” when you die. The beneficiaries can be one or more individuals or even an organization. In most cases, policies are purchased by the person whose life is insured. However, life insurance policies can be taken out by spouses or anyone who is able to prove they have an insurable interest in the person. If you buy insurance on someone else’s life (a spouse, for example), the policy pays when that person dies.

Tim Ellen - Agent with New York Life

A Safety Net For Loved Ones: Choosing the Best Life Insurance

Life Insurance with Living Benefits - Legacy Insurance Group

Life insurance 101: What is Life Insurance? - COUNTRY Financial

What is a Decreasing Term Life Insurance Policy?

Term vs. Perm Life Insurance

Policy Architects The Best Life Insurance in Canada!

Can I Buy Life Insurance Without a Medical Examination?

What Type of Life Insurance Should I Get?

What Type of Life Insurance is Right for you? — Human Investing