The Homeownership Rate and Housing Finance Policy – Part 2: The

4.6 (213) · $ 14.00 · In stock

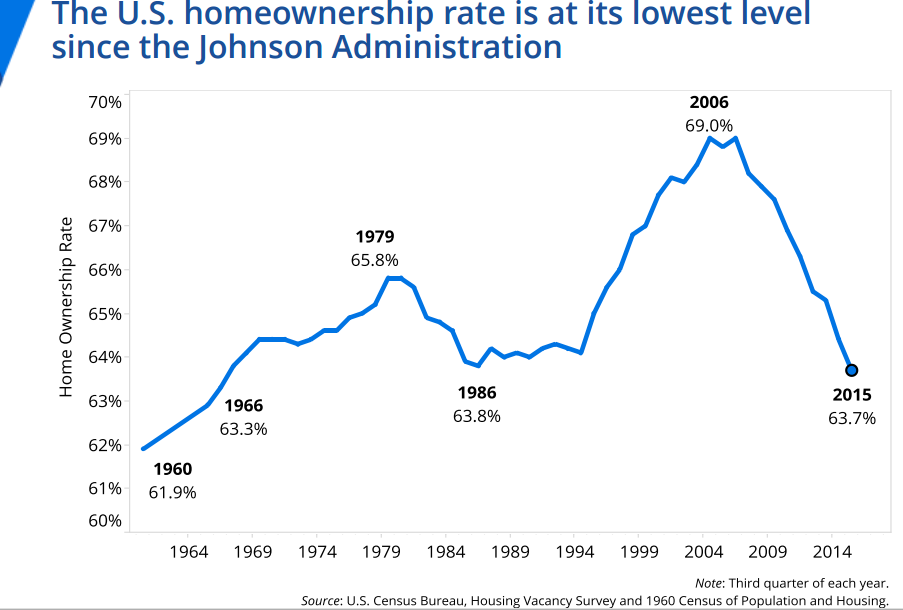

The homeownership rate is broadly regarded by policymakers as a core measure of how well the US socioeconomic system is delivering a good quality of l

U.S. homeownership rate at lowest level since the Johnson Administration: Record low inventory and inflated prices keeps families from buying. » Dr. Housing Bubble Blog

New 2024 Conforming Loan Limits Bring More Opportunities for Homebuyers

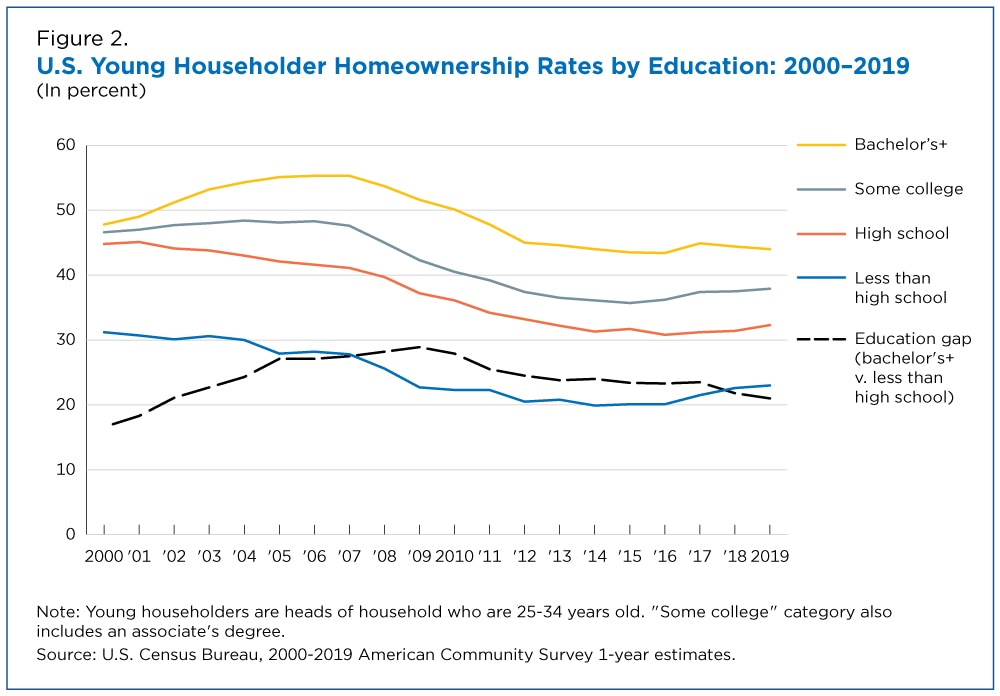

Homeownership by Young Households Below Pre-Great Recession Levels

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

HUD vs. FHA Loans: What's the Difference?

:max_bytes(150000):strip_icc()/factors-affecting-real-estate-market.asp_final-8e8ea4cd40dd45909593384700de9759.png)

4 Key Factors That Drive the Real Estate Market

Homeownership Rate Unchanged at 66%

:max_bytes(150000):strip_icc()/dotdash-the-history-of-lending-discrimination-5076948-Final-93e5c7733a534ae18fd5d08bcd7d08fe.jpg)

The History of Lending Discrimination

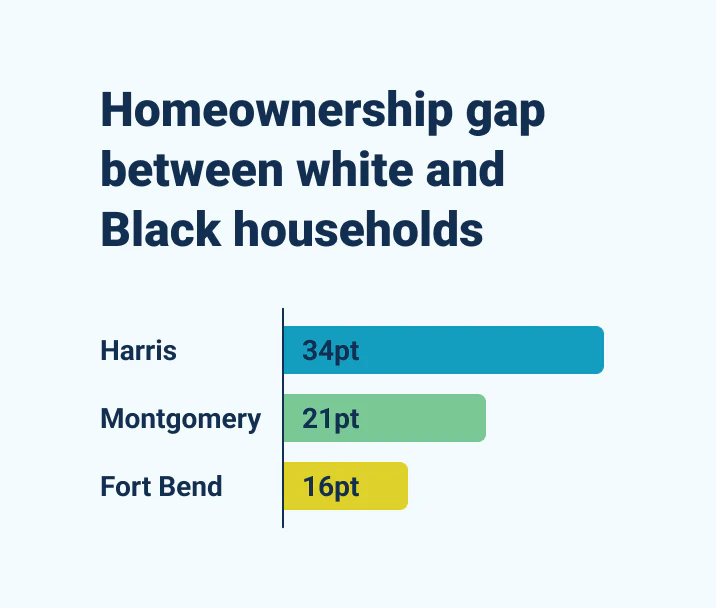

Housing Affordability & Ownership

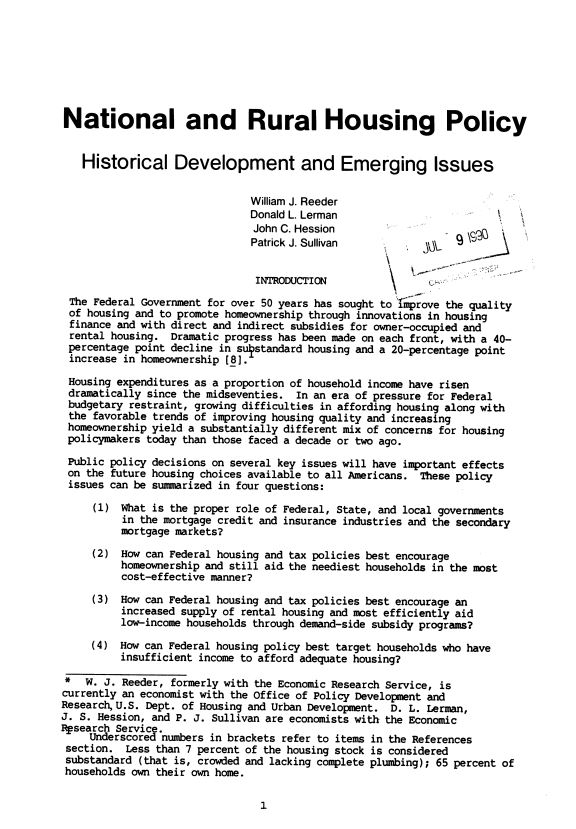

Housing in Rural America, National and rural housing policy : historical development and emerging issues, NAL

Californians: Here's why your housing costs are so high - CalMatters

California's low homeownership rate to continue

![Lift and Separate Page 2 Preview by notzackforwork -- Fur Affinity [dot] net](https://d.furaffinity.net/art/notzackforwork/1669593528/1669593525.notzackforwork_liftandseperate_006.png)