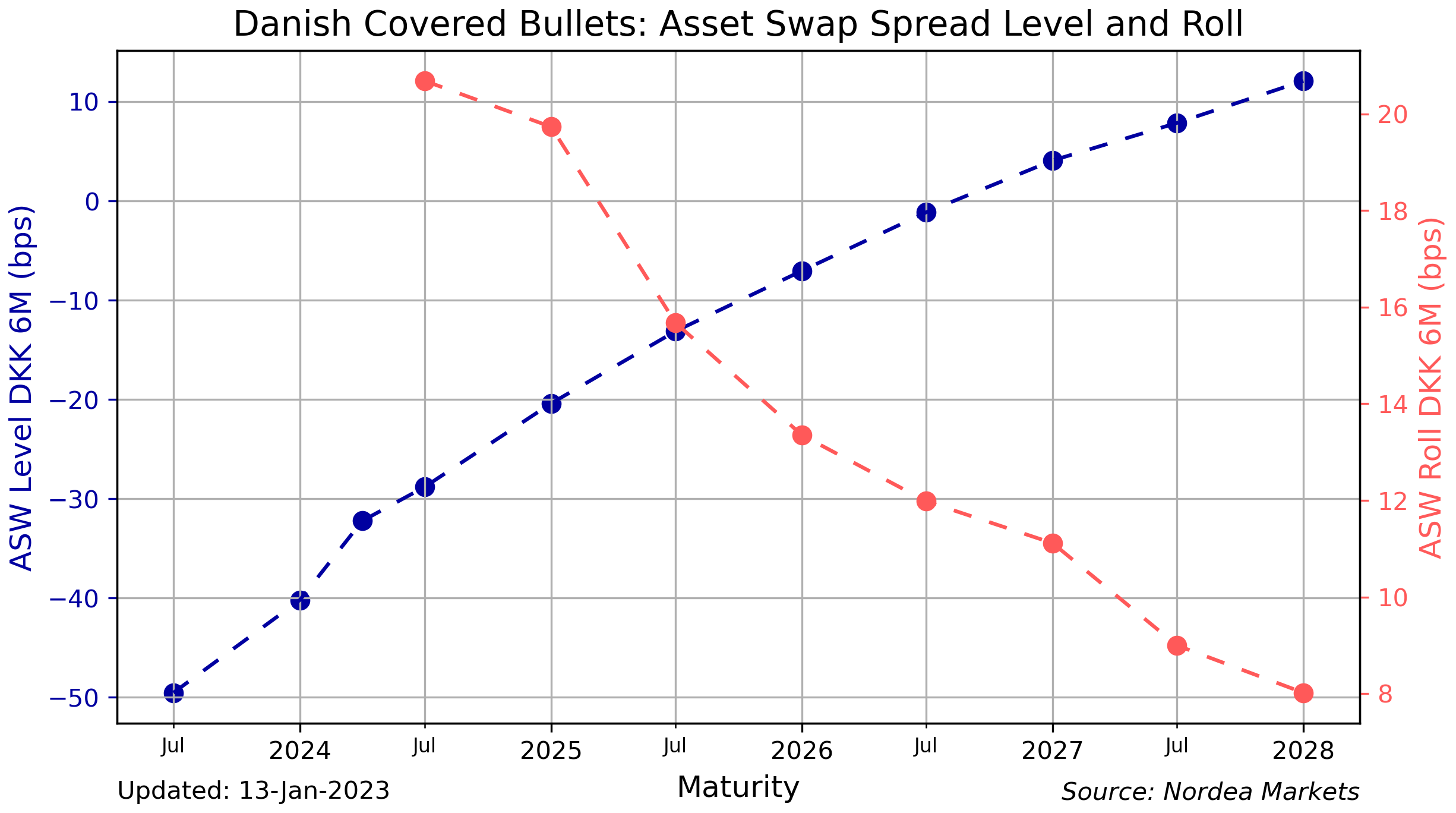

How to calculate carry and roll-down (for a bond future's asset swap) –

5 (378) · $ 23.99 · In stock

Bobl spread is 53.1bp, we are 3 months away from mar18 delivery, and a client blasts “what do you see as carry and roll for OE asw?”. Here are my notes on the mechanics of the calculati…

:max_bytes(150000):strip_icc()/fra.asp-Final-10d52397ba184d6285462cf61f8127b3.png)

Forward Rate Agreement (FRA): Definition, Formulas, and Example

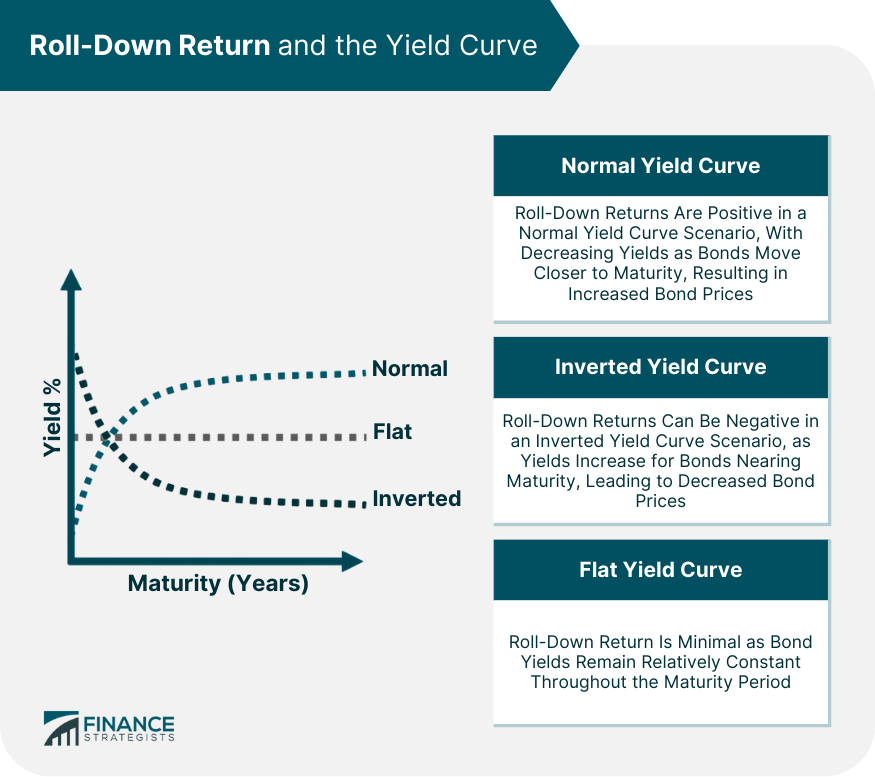

Carry and Roll-Down on a Yield Curve using R code

Credit Derivatives core concepts and glossary

Fixed income: Carry roll down (FRM T4-31)

:max_bytes(150000):strip_icc()/backwardation.asp-final-66a475f384d04ac296eabc200556b64b.jpg)

Backwardation: Definition, Causes, and Example

:max_bytes(150000):strip_icc()/Futures-19f64f0cf82148619e4d485cdb5b2c19.jpg)

What Is Futures Trading?

:max_bytes(150000):strip_icc()/forwardrate.asp-final-abecab1927554cd58edbbe2e392e4b80.png)

Forward Rate: Definition, Uses, and Calculations

Fixed income: Carry roll down (FRM T4-31)

Roll-Down Return Definition, Elements, Calculation, Applications

Bonds & bold: When is roll a good predictor of future returns?