Not for Profit: Definitions and What It Means for Taxes

4.8 (185) · $ 21.99 · In stock

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)

Not for profit refers to a type of organization or enterprise that does not earn profits for its owners.

:max_bytes(150000):strip_icc()/Marginal_Tax_Rate_Final-7cae08bcc3934971b56e7650050f99f1.jpg)

Marginal Tax Rate: What It Is and How to Calculate It, With Examples

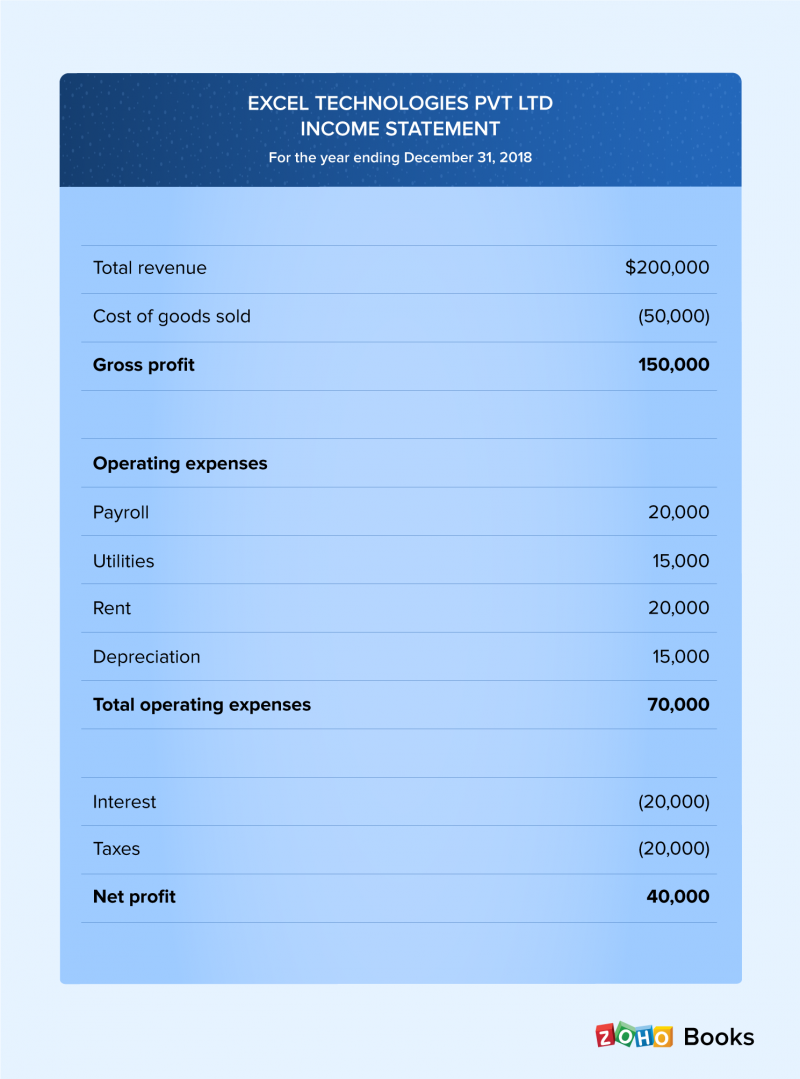

Difference between gross profit and net profit - Zoho Books

:max_bytes(150000):strip_icc()/JBJHeadshot-JanetBerry-Johnson-238498f91a144bf082ed759d0b1c86a8.jpg)

Not for Profit: Definitions and What It Means for Taxes

:max_bytes(150000):strip_icc()/GettyImages-862362468-61bc8ee31b0d4249a377b3e8b5194293.jpg)

Qualified Charitable Organization: Meaning, Rules, FAQs

:max_bytes(150000):strip_icc()/101405194-5bfc2b8c46e0fb0051bddfc9.jpg)

Charitable Lead Trust: Meaning, Pros and Cons, FAQs

:max_bytes(150000):strip_icc()/non-executive-director.asp-final-119d2188aa3e4bcbb9b61517054647d7.png)

What Is an Executive Director? Definition and Non-Profit Duties

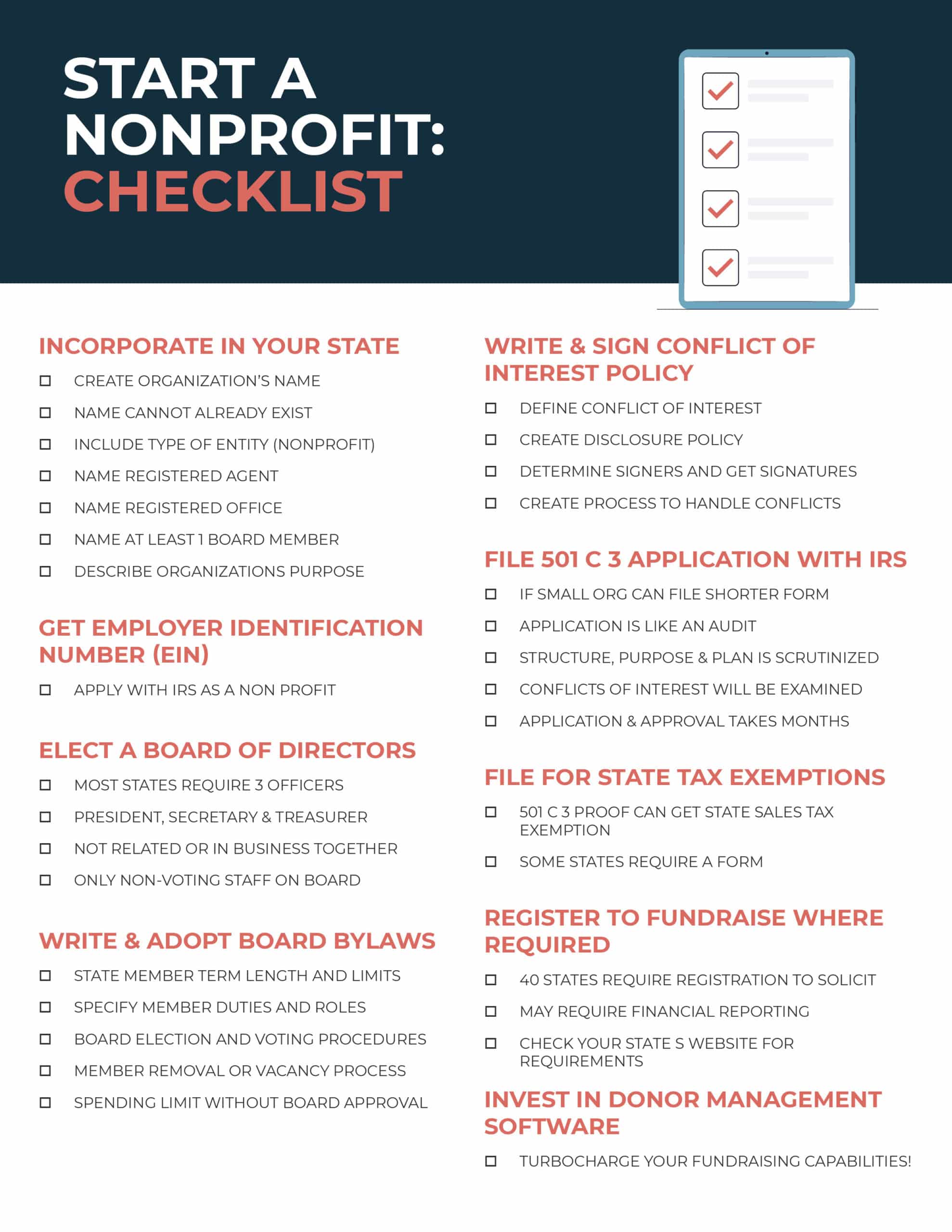

How to Start a Nonprofit: Complete 9-Step Guide for Success

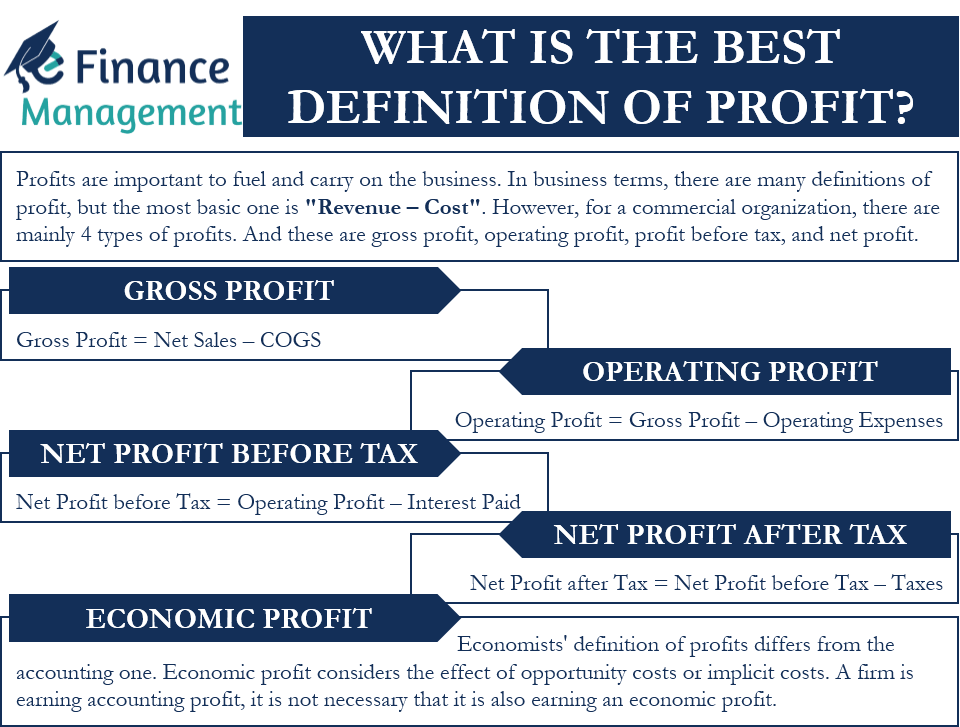

What is the Best Definition of Profit?

:max_bytes(150000):strip_icc()/INV_Tax_GivingtoCharityCanSaveYouMoney-1a82e3b41566497f8fcc827e420107a6.png)

Donations: 5 Ways to Maximize Your Tax Deduction

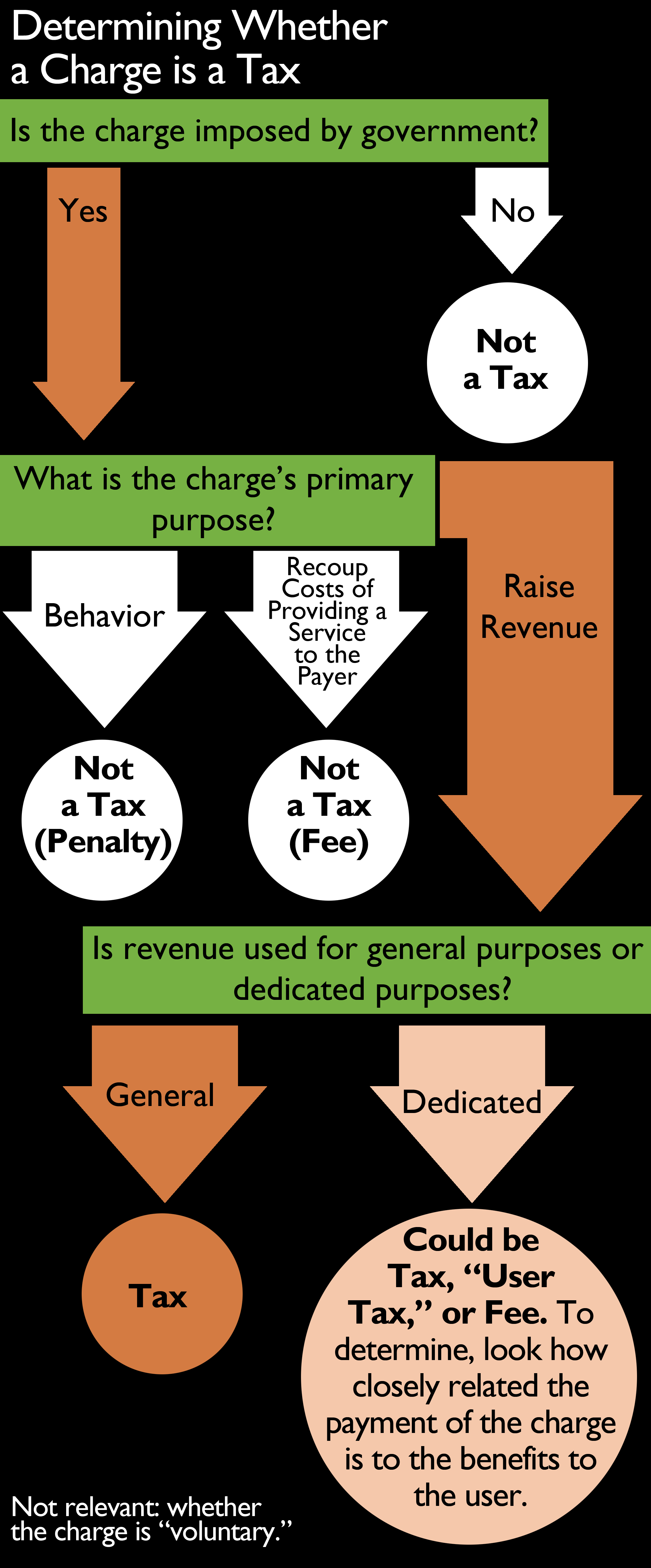

Taxes and Fees: How Is the Money Used?

:max_bytes(150000):strip_icc()/woman-giving-her-friend-a-wrapped-christmas-gift-926870570-5b88456c46e0fb00505f7dd6.jpg)

Giving Tuesday Definition, Taxes, and Impact

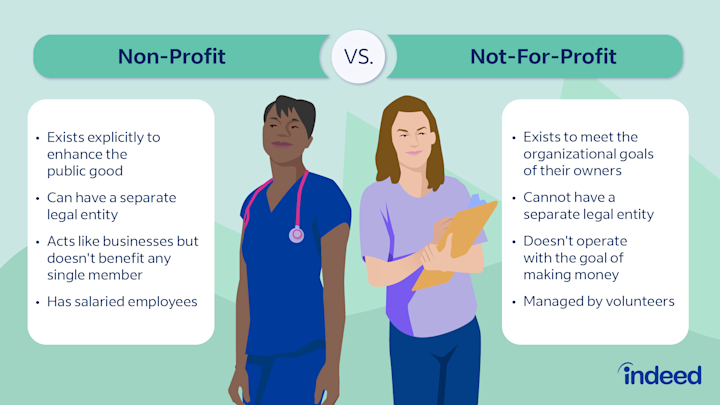

For-Profit vs. Non-Profit Organizations: Key Differences